Secure Online Banking - These Are the Tricks of Cyber Fraudsters

Secure online banking - that is no longer guaranteed. More and more people are using online banking or mobile banking: According to Bitkom, 73 percent of Internet users are already doing their banking on the Internet. Even more, than half of those over 65 manage their transfers and standing orders from the comfort of their home or even when they are on the move from their smartphone. The many advantages of the convenient administration of money and financial transactions are obvious - but attacks on "personal online banking" are becoming more and more unabashed. Cybercriminals smell the big, fast money here, so that online banking is no longer secure.

Secure online banking - these are the greatest security risks:1. Email phishing:

password theft with manipulated emails. In online banking, customers use the

PIN-TAN procedure to prove their identity. If online fraudsters get this

information, they will ransack the victim's accounts. The procedure: The

victims receive e-mails that supposedly come officially from the credit

institutions. Customers are asked to click on links that would lead to the

bank's website. In truth, the victims end up on "faked" websites.

There, the entered account data, PIN, and TAN numbers are fished and used for

illegal transactions.

Read the article Protection against phishing

here.

2. Online banking less and less secure: Due to malware, Trojans, and malware: Cybercriminals bring

malware such as Trojan horses onto banking customers' computers and secretly

collect data. The fatal thing: the malware runs in the background, the user

does not notice them. These are the two most important ways to get your money:

· “Man-In-The-Middle” attack: the banking customer in the

middle of the transaction of data traffic between the computer's browser and

the bank's server are manipulated. When he transfers money, the banking malware

intercepts the data, modifies the amount and the recipient's account number and

forwards the transfer amount to its own accounts, often abroad.

· "Man-In-The-Browser" attack: manipulation via the

display of the online banking website in the web browser. After entering the

correct URL, the correct online banking website of the credit institution is

redirected to a registration website of the externally identical bank portal.

The address bar even suggests that the selected address is correct. Enter your

account number, PIN, and TAN, and the money is gone.

More about protection against malware.

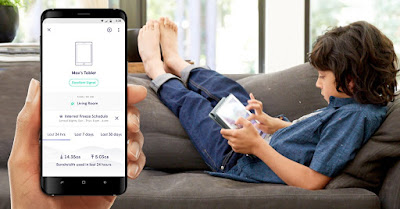

3. Mobile banking:

Handling banking matters in a holiday hotel in Vietnam is a great promise in

the digital world for more freedom and flexibility. But especially in mobile

banking via the free WLAN or in the Internet café, there is an enormous risk

potential for your own account. These are the most important dangers in mobile

banking:

·Theft of the smartphone. If personal banking data is regularly

saved on the mobile phone, the resourceful robbers may have an easy hand when

emptying the account.

·Unprotected mobile devices. Anyone who does banking on the

move should always make sure that they have set the keypad lock with a PIN and

that third parties cannot see the bank details entered.

·Use of the public WiFi. If the radio connection is not secure

or encrypted, bank data can be intercepted.

·Use of third-party computers. If a vacationer uses the

Internet café in a foreign country, there is a risk that the undeleted bank

data will remain in the cache and be accessed.

·Security gaps in mobile banking apps. Almost all banks offer

their customers applications for mobile banking via the app stores, which offer

the full convenience of banking via the browser. Unfortunately, it is regularly

announced that these are not free from security holes.

·Data espionage through SMS. Users receive a short message on

their smartphone with a link to an alleged update of the banking security

certificate. The link installs espionage software that spies out mobile TANs

and can lead to account manipulation.

·Mobile malware on smartphones and tablets. In general, the

same security risks exist on mobile devices as on stationary computers. If no

antivirus or antimalware software is installed on smartphones or tablets, or if

regular updates are uninstalled, such security gaps can quickly be exploited by

cyber fraudsters and online banking security is at risk.

Comments

Post a Comment